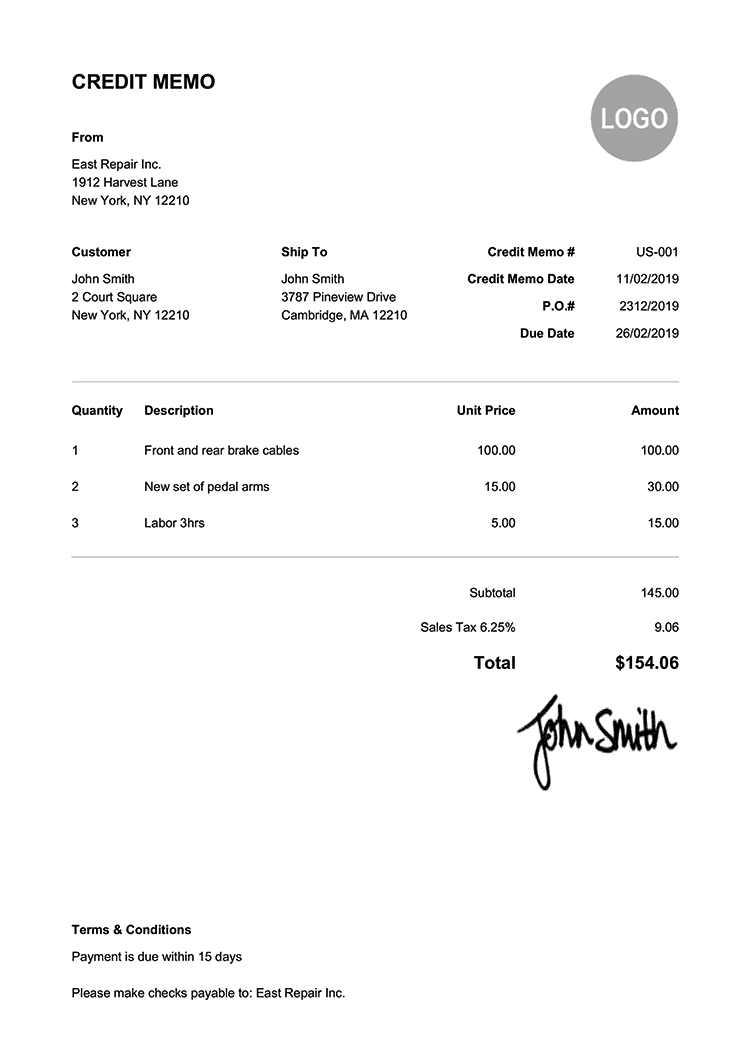

The seller records the credit memo as a reduction of its accounts receivable balance, while the buyer records it as a reduction in its accounts payable balance.Ī credit memo can be divided into three parts, the header, body, and footer. It usually includes details of exactly why the amount stated on the memo has been issued, which can be used further to collect information about credit memos to determine why the seller is issuing them. It may also be known as a financial document which is issued officially by businesses during every notable transaction.

#CREDIT MEMO TEMPLATE FULL#

It may also be issued because, or for some other reason the buyer will not pay the seller the full amount of the invoice. You can put comments or notes to the customer at the end of the credit memo template.Ī credit memo is an abbreviation of the term “credit memorandum”, a document issued by the seller of goods or services to the buyer for different reasons such as the buyer returned goods to the seller, or there is a pricing dispute, or marketing allowance. Lastly, add the sub total and sales tax then put it into the line you will label as ‘total’.Ħ. Then multiply the sub total with the sales tax and name the line ‘sales tax’. Afterwards, calculate the total from the last column and write the total in at the bottom of the memo with a name ‘sub-total’. Label the columns with an appropriate name.ĥ. Make a table to list down the quantity of each credited item in the first column, the item number in the second column, description of the item in the third column, unit price in the fourth column, and lastly the line total which is by multiplying the item’s prize with the quantity. Next is, the detailed information must be enlisted in a table.

After indicating whom it is to be sent to, on the next portion, indicate the sales person, if there is any, the invoice number, order number and especially the payment term.Ĥ. Included are the customer’s business name, address and contact information.ģ. And opposite to that is to whom you are sending the credit memo. In other cases, underneath the company logo is the business name and contact information of the sender of the credit memo. On the upper left side of the page, you are able to place your company logo and its slogan, if there is any.

After doing so, you can place the credit date just below it and underneath is a unique number assigned for the credit memo.Ģ. First off, make sure to indicate the words “CREDIT MEMO” at the upper right side of the page to avoid getting the credit memo meaning as an invoice. Here is a list of steps to be done when making a credit memo sample:ġ.

#CREDIT MEMO TEMPLATE HOW TO#

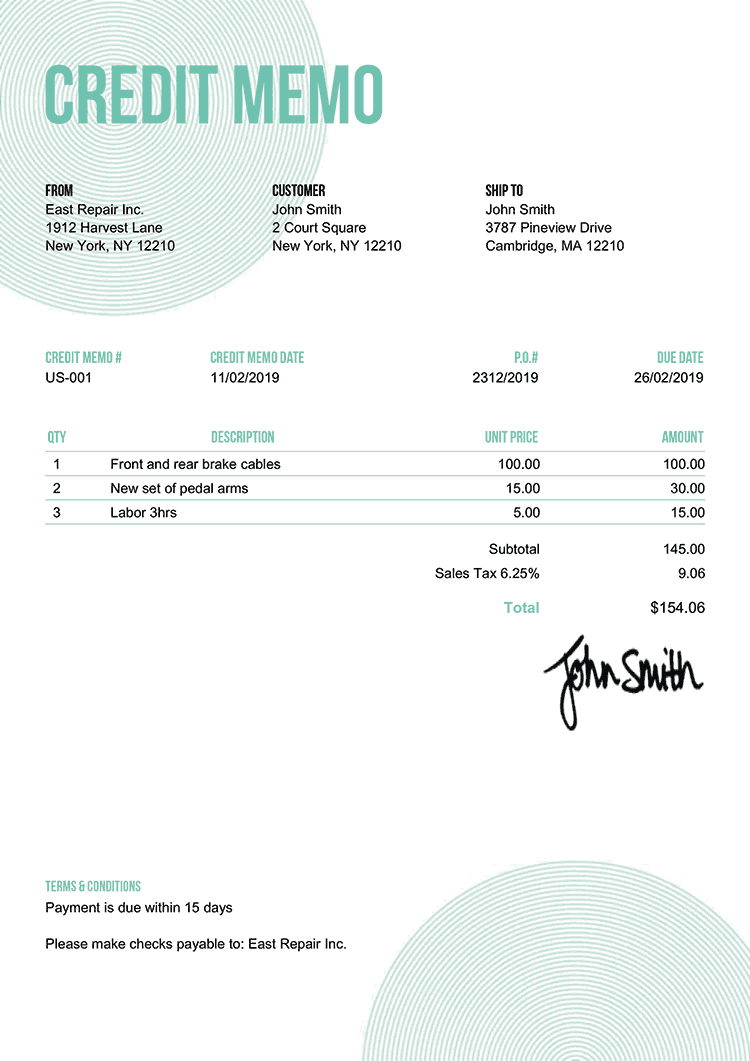

Making a Credit Memo should be real easy when someone has the knowledge on how to do so. The table also automatically calculates the totals and discounts for you to prevent errors.A credit memorandum is a negative invoice used when there is a difference in the customer's original order or billed amount that may cause the customer to be in deep debt. Here, you can type in the details of the credit or debit for a particular product or service, as well as the corresponding amounts. There’s enough space for your location and contact details, however long they may be.Īt the bottom of this is the table for all your products or services. There’s the name of the company or individual, complete address, and contact numbers. Then, the information section shows where the memo comes from and where it is going to. This template features a single worksheet tab that allows you to put a check mark whether you want to create a Debit or Credit memo.

#CREDIT MEMO TEMPLATE PROFESSIONAL#

This template provides a convenient way for you to create and send memos to your customers in a way that looks professional and versatile for whatever your business needs and branding strategies are. The Credit & Debit Memo Excel Template is a wonderful, convenient template that allows you to instantly create Credit and Debit Memos for your customers.

0 kommentar(er)

0 kommentar(er)